From the buyer’s perspective, a business that can show healthy cash flow, that’s well maintained and enjoying sustained growth, is much more attractive. Canada’s population is aging and Canadian entrepreneurs are no exception. In fact, close to 60% of Canada’s small and mid-sized business owners are aged 50 or older, nearly double the proportion of the overall […]

Family successions: How to minimize your taxes

Planning can help you significantly reduce your tax liability in a succession. Failing to do so could mean the business has to close or be sold. Or perhaps it might have to incur an unhealthy level of debt. Taxes are one of the main considerations when it comes to family succession. Without proper planning, you […]

Benefits of succession planning

Planning a successful business succession takes years. According to experts, transitions can take up to five years to complete and, in the case of a family business, as many as 10, depending on the firm’s size and complexity. A recent survey of 2,500 entrepreneurs found that five out of six entrepreneurs surveyed estimate that the process will […]

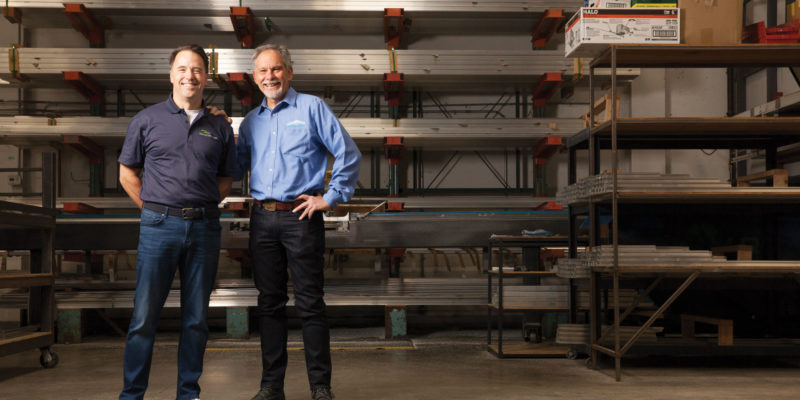

Succession planning: Secrets of a smooth transition in a family business

You started your business 30 years ago with a few family members and now you have a 100-employee company and your adult children are actively involved. Mentoring, trust and a deep knowledge of the business have been the keys to a smooth transition from one generation to the next. One of the benefits of your […]