As a business owner, we want you to feel confident about your retirement. An Individual Pension Plan (IPP) is a defined benefit pension plan that allows you to increase your retirement savings and establish long-term financial security.

The complete guide on Individual Pension Plans including 3 Case Studies

Why Now

- On July 18, 2017 the Department of Finance announced proposed changes to the tax rules governing private corporations

- The accumulation of investment income within a private corporation is considerably less attractive and use of IPP mitigates the impact of new passive income rules

- TOSI (Tax on Split Income) rules have curtailed income splitting

- Life annuity from IPP (including bridge benefits) will allow for income splitting, per the Pension Splitting rules

Other Advantages of an IPP

- Retirement income from IPP can be expected to be larger than that provided from an RRSP

- All contributions, and actuarial, administrative or financial management fees, are tax-deductible to the employer

- Can safeguard corporation against losing access to enhanced capital gains deduction

- Interest paid in respect of funding contributions to the pension is deductible

- Retirement income from IPP can be expected to be larger than that provided from an RRSP

- Contributions are exempt from employer payroll taxes (eg, EHT in Ontario

- Pension income can be split with a spouse as soon as retirement benefits commence to be paid, even before the age of 65

Are you a good fit for an IPP?

An Individual Pension Plan (IPP) is specifically designed for business owners – including incorporated professionals who own the corporation that employs them.

- Starting at age 40 and over (ideally 50+)

- If there is a lengthy period of (even modest) earnings or a more recent period of high earnings ($100,000+)

- Those soon to be retiring and seeking a deduction for the terminal funding

- Business owners who are contemplating the sale of their business looking to pay less Capital Gains

An IPP is NOT well suited for:

- Sole proprietors and partners of partnerships

- Business owners who rely on dividends and compensation other than T4

- Highly cyclical businesses

Who should consider an IPP?

Think of IPPs as basically RRSPs on steroids. They’re designed to allow an owner of a corporation to transfer cash trapped on the balance sheet to his/her pension. Companies with solid, stable cash-flow are ideal for this strategy.

- Personal services businesses

- Those of any age with significant registered assets

- Employees of companies that hold excess passive assets, where access to the Capital Gains Exemption is at risk

- Employees entitled to a Commuted Value, where still permitted post-2019 Federal Budget

Key benefits of an Individual Pension (IPP)

An Individual Pension Plan (IPP) is specifically designed for business owners – including incorporated professionals who own the corporation that employs them.

- An excellent way to increase your retirement assets and have your company make large tax-deductible contributions

- Allows for significant additional tax-deductible contributions at inception and retirement

- Can make lump sum contributions for past service back to 1991 (or before if certain circumstances are met). In addition, can make lump sum contribution at retirement to fund certain ancillary benefits.

- Contributions are tax-deductible to the corporation; as well, they are not taxable benefits to the employee (beneficiary) of the plan.

- Tax-deductible unused room (Past Service) contributions from your company, up to $900,000+

- Safer investment rules and limitations compared to the RRSP

- Allows for additional tax-deductible contributions to be made by the company should the rate of return on plan assets be less than 7.5% a year

- Pension plan surpluses belong to the member

- Pre-determines retirement benefits

- 100% creditor proof

- No deemed disposition of plan assets upon death in certain situations. Plan assets remain in the plan to provide benefits to surviving members

- All costs associated with the pension plan are tax-deductible to the company

How an IPP works

An IPP is similar to an RRSP in that it uses an investment account to accumulate assets over time as retirement benefits. However, unlike the RRSP, an IPP allows for the accumulation of greater assets – up to 65% more than an RRSP, and like a traditional pension plan, sets your monthly income at retirement.

An actuary will determine the contributions required in order to fund the promised pension benefit. The actuarial valuation must be completed at least once every three or four years, depending on provincial legislation. Over time, the IPP fund may be in a surplus or deficit position as the actual rates of return may differ from the actuarial assumptions prescribed by the Income Tax Act. If the IPP is facing a surplus that exceeds prescribed limits, contributions may need to be reduced or halted. Conversely, if the IPP is facing a deficit, additional contributions may be required, must be supported by an actuarial valuation report, and would be deductible for tax purposes.

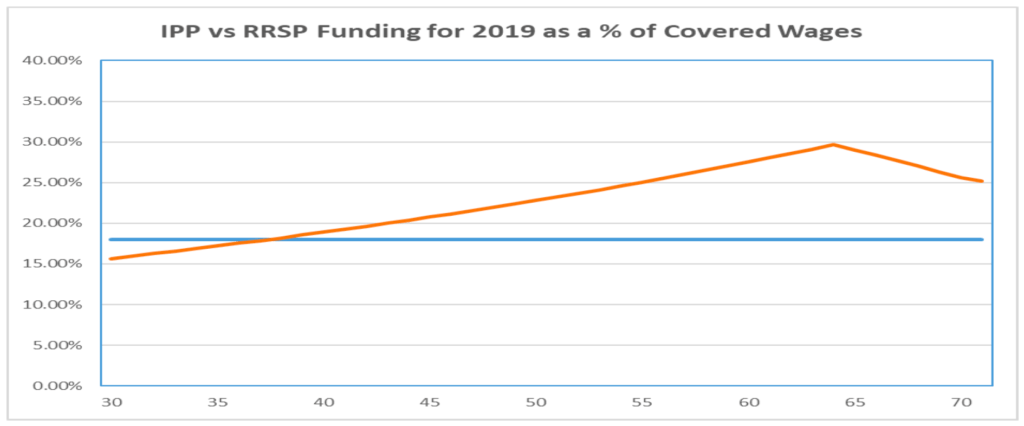

Funding an IPP vs RRSP as a % of Wages

The chart below illustrates the advantage of an IPP vs an RRSP as a percentage of covered wages. The blue line represents an RRSP and the orange line represents an IPP. As mentioned earlier, age 50+ is ideal as the percentage difference is significantly higher for an IPP.

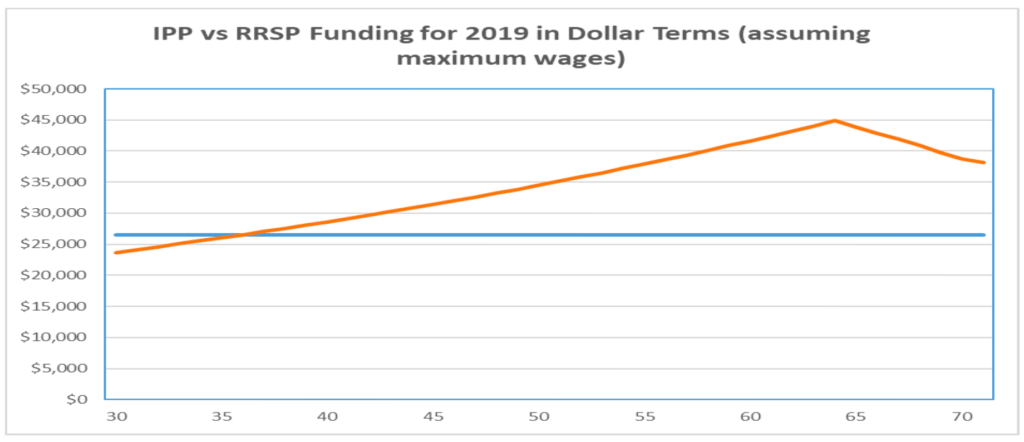

Funding an IPP vs RRSP in Dollars

The chart below illustrates the advantage of an IPP vs an RRSP in terms of dollars (assuming maximum wages). The blue line represents an RRSP and the orange line represents an IPP. As mentioned earlier, age 50+ is ideal as the percentage difference is significantly higher for an IPP.

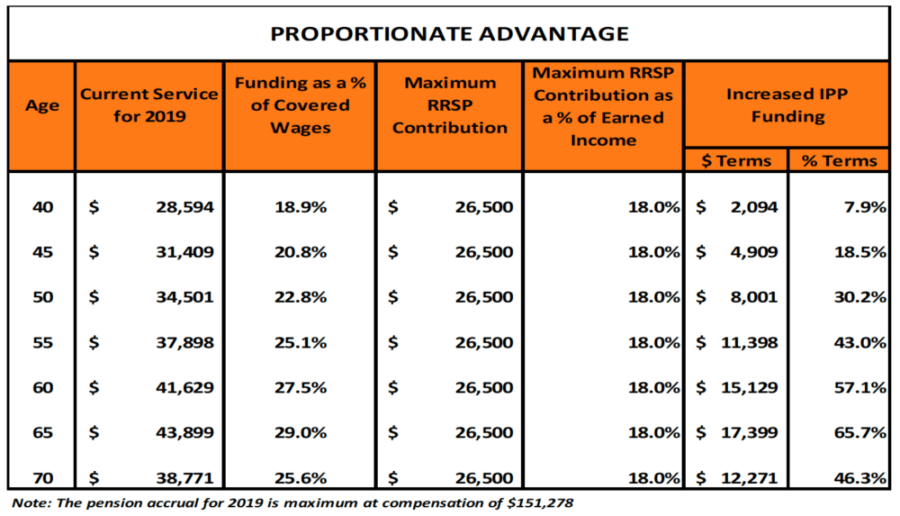

IPP Funding Advantage vs an RRSP

The chart below illustrates the funding advantage of an IPP vs an RRSP. As shown at age 65; assuming wages of $151,278, a business owner can significantly deposit more to an IPP. In this example a deposit of $43,899 which is 29% of wages compared to $26,500 to an RRSP which is only 18% of earned income.

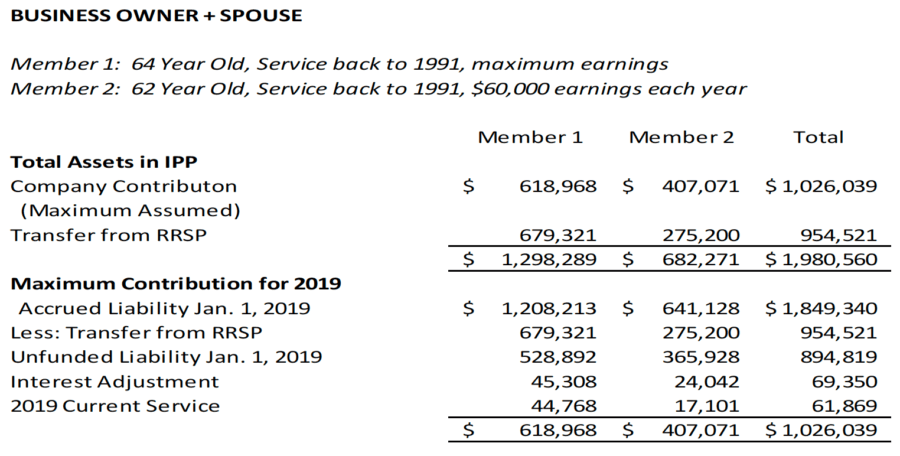

Case Study #1 – The Entrepreneur

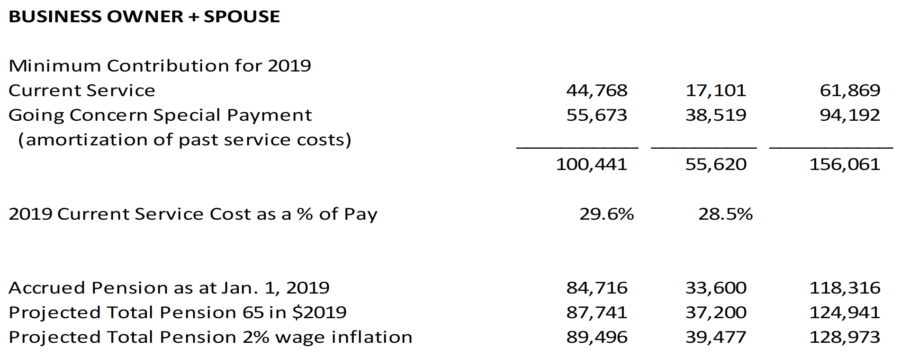

Owner Manager, aged 64 has run a successful business for decades and is now wishing to enhance their retirement assets, bring predictability to retirement income and realize some tax relief (particularly if they are on the wrong side of the new Passive Income rules).

- Spouse is 62 and has taken income for years. This year they were paid $60k.

In the example below for “The Entrepreneur” the actuary has determined the company can immediately fund the pension $1,980,560. This represents the total amount of money which can be deposited for previous years wages (all the way back to 1991). The plan member begins funding the pension by transferring in their existing RRSP account ($954,521). (If there are no RRSPs then all of the funding comes from the company.) The company funds the remaining difference ($1,026,039) to the pension now or within 15 years.

- Immediate increase of funding to the retirement account

- Increase in funding from 18% (RRSP) to 29.5% (IPP

- This example provides a pension income of $128,973 per year

- Tax deduction to the corporation

- No need to pay yourself more money in order to make an RRSP deposit

- Deposits come from the company

- Creditor protection

- Move cash off the balance sheet which is getting passive income tax treatment

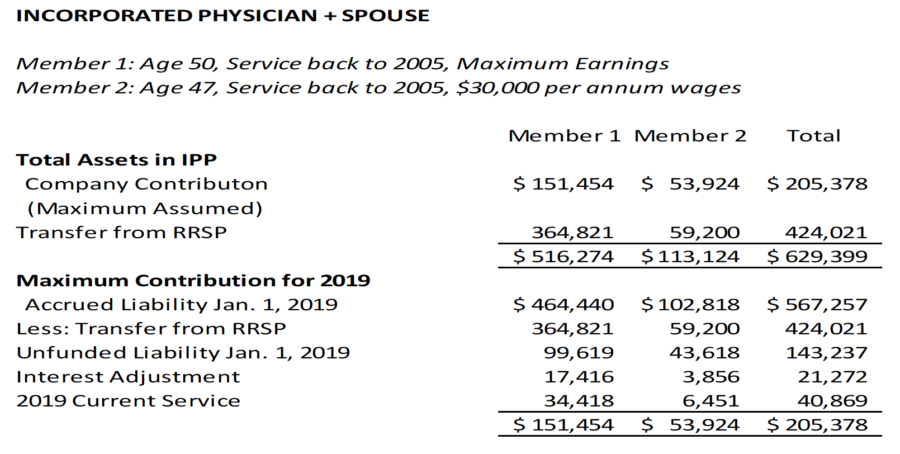

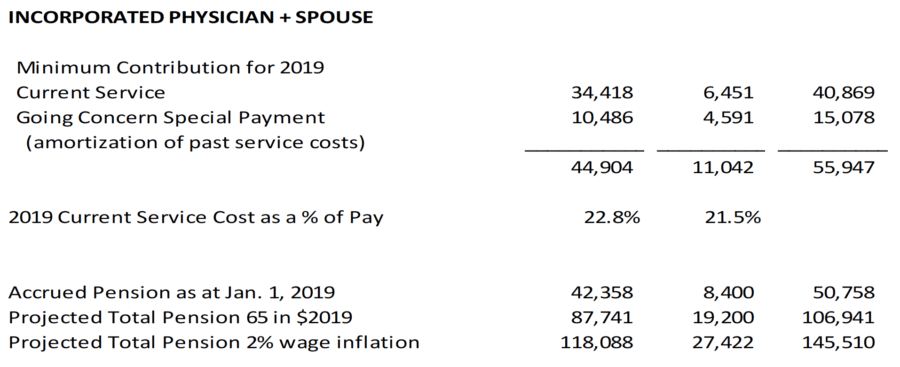

Case Study #2 – The Incorporated Physician

Ontario physician incorporated in 2005 to take advantage of the amended rules on incorporation. The physician was paid enough salary to maximize RRSP contributions (and later IPP contributions) and their spouse took some dividends and $30,000 per year.

The physician now 50 (spouse 47) has finally got ahead of the considerable amount of debt associated with their education and mortgage). They are also concerned that the recent tax changes has them in the crosshairs of government as to future savings.

In the example below for “The Incorporated Physician” the actuary has determined the company can immediately fund the pension $629,399. This represents the total amount of money that can be deposited for previous years’ wages (back to 2005 when the physician was employed by his corporation). The plan member begins funding the pension by transferring in their existing RRSP account ($424,021). (If there are no RRSPs then all of the funding comes from the company.) The company funds the remaining difference ($205,378) to the pension now or within 15 years.

- Immediate increase of funding to the retirement account

- Tax deduction to the corporation

- No need to pay yourself more money in order to make an RRSP deposit

- Deposits come from the company

- Creditor protection

- Move cash off the balance sheet which is getting passive income tax treatment

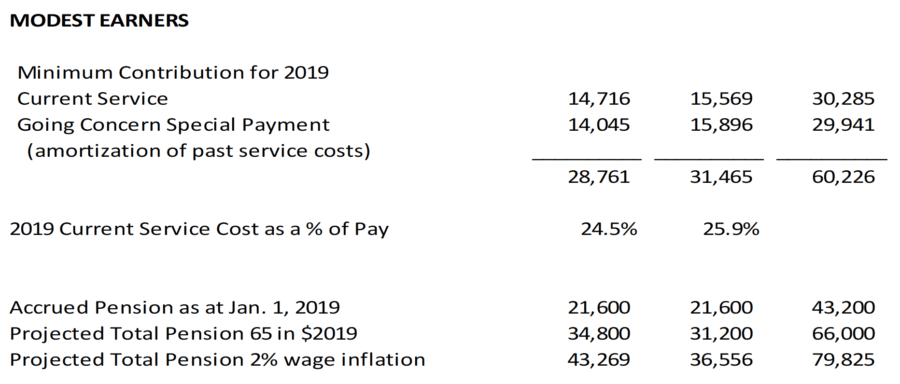

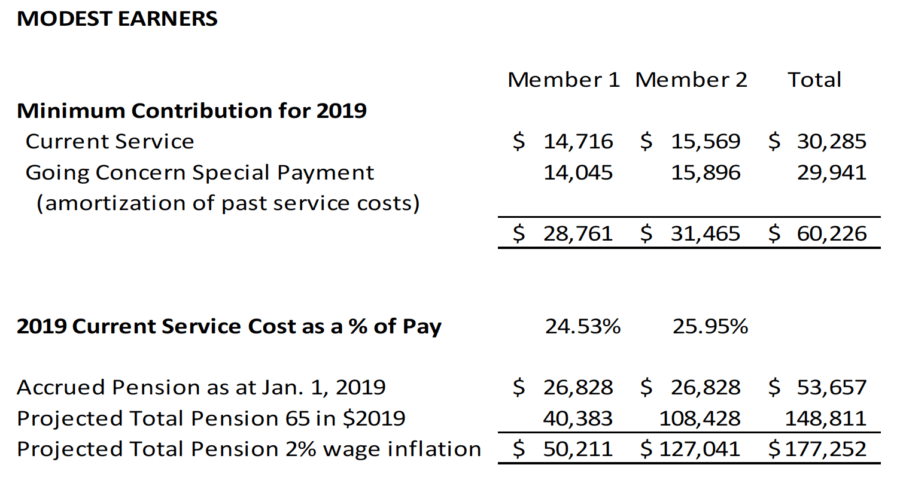

Case Study #3 – The Modest T4 Earner

This couple has been drawing dividends and salary from their corporation, which they incorporated in 2001

- They are 57 and 54 respectively

- Their T4 earnings might be considered modest ($60,000 each), as they lived off the dividends that they received

To find out if this strategy is right for you, schedule your confidential, no-obligation meeting.