Help reassure your loved ones that they will be taken care of now and in the future.

Life insurance provides whomever you choose with a one-time, tax-free payment when you die, as long as you continue to pay your premiums.

There are different types of life insurance, and different ways to make it work for you. It’s not only to protect your family. It can also be part of your financial plan, so you may be able to access money in your policy while you’re alive.

What kind of life insurance are available?

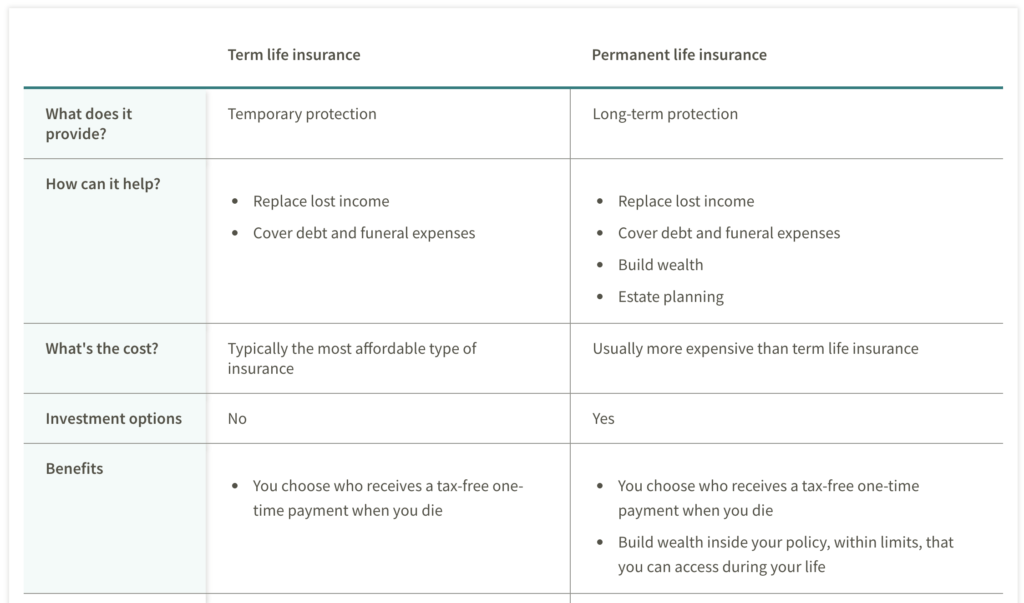

There are 2 basic types of life insurance coverage: term and permanent. Each has unique features designed to meet different needs.

Term insurance

- Temporary coverage

- Lower cost

- Fixed payments

- Option to convert to permanent

Permanent insurance

- Lifetime coverage

- Higher cost

- Flexible payments

- Opportunity to build cash value

What kind of insurance do you need?

How much insurance coverage do you need?

Ideally, you want to make sure your debts are covered, so you don’t leave major expenses behind for your loved ones.

Here are a few things to consider:

- Your income

- Net worth

- Family needs

- Debt

- Other insurance you have

How much does insurance cost?

It depends on the type of coverage you choose. Generally, term insurance is more affordable than permanent insurance. But there are a lot of factors that determine the cost of your policy, including:

Find out how much insurance you need

FREE Insurance Analysis