The returns you expect. Less risk and volatility. Our investment approach is purpose-built to protect and grow capital in a more stable fashion.

While personal circumstances vary, our clients all seek to:

- Protect their money from significant or permanent loss

- Generate enough income to fund their lifestyle, now or in the future

- Provide growth to protect their standard of living long term

- Delegate the management of their assets to trusted experts

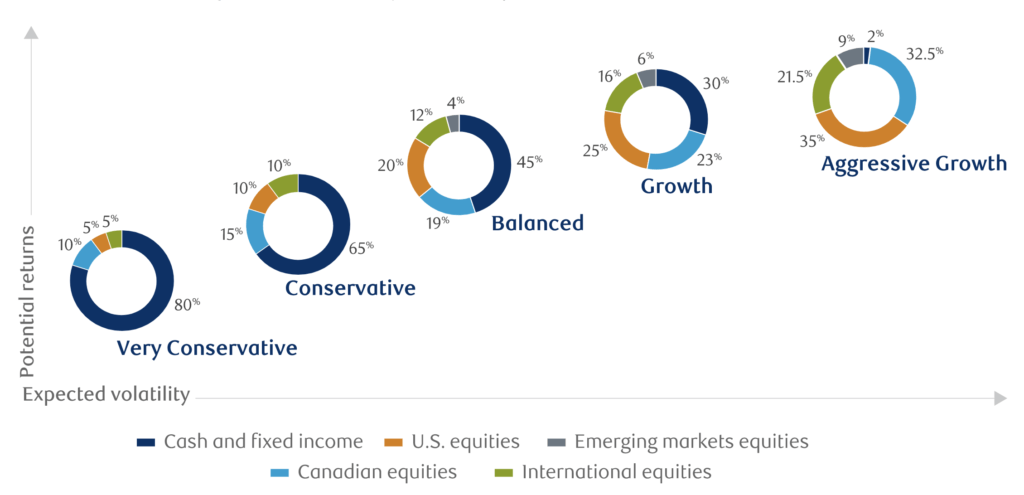

For most investors, ‘diversification’ means owning a mix of traditional public securities – stocks, bonds, ETFs, mutual funds and REITs – to spread risk and enhance returns.

Asset mix is traditionally ‘60/40’ (60% stocks, 40% bonds) or a variation thereof, depending on age and risk tolerance.

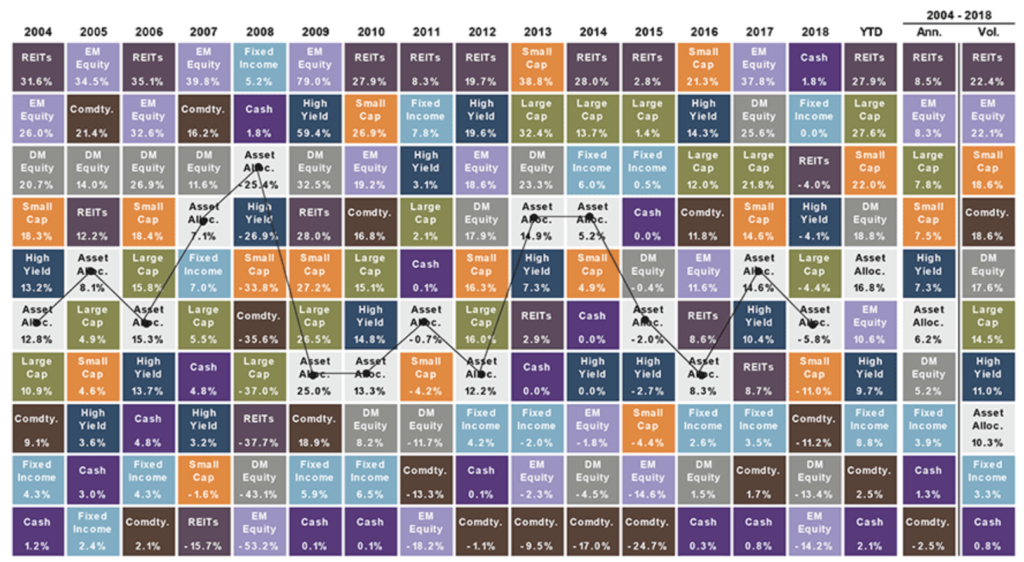

Dynamic asset allocation is an important plank in our investment platform, as multiple research studies have shown asset mix explains approximately 90% of a portfolio’s variability of returns.

The chart below illustrates the need for broad diversification and careful portfolio management. The Asset Allocation model provides a well-diversified portfolio.