How to increase your rate of return without increasing risk.

During a recent Second Opinion portfolio review, I compared a portfolio a couple had with a bank against my recommended portfolio. They immediately made a comment about their MER (management expense ratio or cost to investing) was higher than expected.

Another area was the overlap of funds in their portfolio. It’s very common during the Second Opinion portfolio review to find this. Examples of this are 2 Canadian balanced funds or 2 Dividend funds. Think of it as having a McIntosh & Red Delicious apples. Their both apples with slightly different crunches, but essential both apples. What you want is the best apple, best pear, best banana, etc. A basket of the best investments, with as little similarity as possible and all designed with a goal in mind.

The recommended portfolio had funds within their risk tolerance, very little overlap and a lower MER. More importantly, the portfolio was designed through Goal-Based planning.

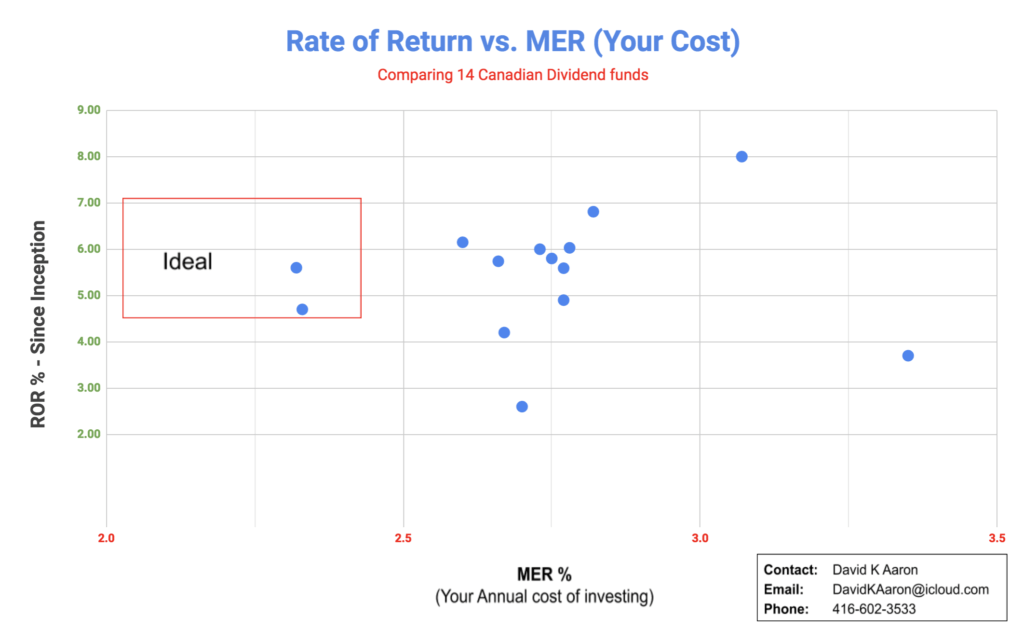

Comparing 14 Canadian Dividend funds

The chart below compares 14 Canadian Dividend funds against their cost (MER) and their Rate of Return (since inception). Ideally, you want to pay the least amount of money (fees & charges) with the highest return (within your risk tolerance). The question is: Do you know what you have and how much it costs?

Leave a Reply