With the effects of the Coronavirus being felt worldwide and the unfolding drama of a US election this year, expect more volatile markets

Key Points:

- There have been 26 market corrections (not including Thursday ) since World War II with an average decline of 13.7%.

- Recoveries have taken four months on average.

- The most recent corrections occurred from September 2018 to December 2018. The S&P 500 bounced into and out of correction territory throughout the autumn of 2018.

- This has been the fastest 10% decline from an all-time high in history.

Stock market corrections are scary but normal. In fact, they’re a sign of a healthy market in most cases. A stock market correction is usually defined as a drop in stock prices of 10 percent or greater from their most recent peak. If prices drop by 20 percent or more, it is then called a bear market.

What to do during a market correction

First, resist the urge to “time the market.” Although it’s possible to make some short-term money trading the ups and downs of the market, it’s very difficult for the average investor to build long-term wealth by timing the market.

Most people lose money by trying to move their money around to participate in the ups and avoid the downs. Data show that not only do most people lack the discipline to stick to a winning investing strategy in correcting markets, but they also tend to transact at the wrong times causing even larger losses.

When we build a portfolio, we expect that one out of every 4 calendar quarters will have a negative return. We control the magnitude of the negative returns by selecting a mix of investments that have either more potential for upside less potential for high returns and also less risk—called diversification.

If you’re going to invest in the market, it is best to understand that stock market corrections are going to occur, and it’s often best to just ride them out. Resist the urge to trade and profit from them. Follow the old Wall Street cliche—never catch a falling knife.

How to lessen the impact of short-term market volatility on your portfolio

- Communicate: Start talking to your advisor. Communication is very important during market corrections.

- Get a Portfolio Review: What types of investments are you holding. Are they in-line with your risk tolerance? We’ve been in the longest bull market in history and it’s likely your portfolio is in need of rebalancing.

- Timeline: What stage are you in with your retirement horizon? Are you 40 or 60? If your young market corrections are excellent opportunities to take advantage of lower market valuations.

- Near Retirement: If your near retirement, the most detrimental aspect of investing is negative returns within 5 years of retirement and 5 years into retirement. Reevaluate your risk tolerance especially if the only assets you have to provide retirement income is your investment account.

- Cash: Consider having enough cash in the bank to fund your annual expenses. Making withdrawals during negative returns amplifies the effect negative returns on your portfolio.

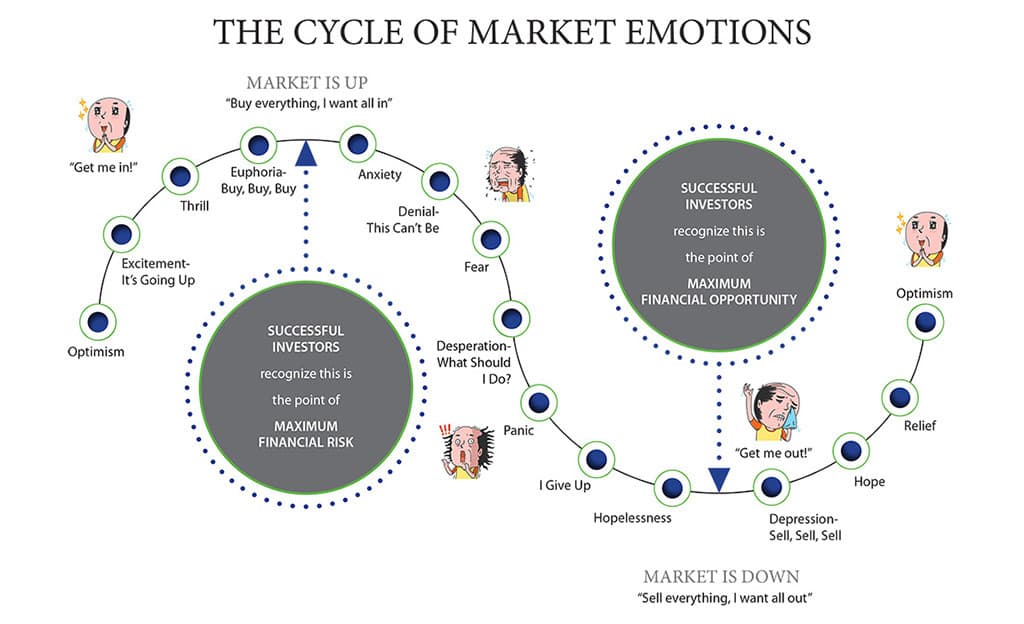

Market Correction Infographic

Looking for more information on Market Corrections? Here’s a great infographic that dives deep on market corrections. Click here.

Let me know your thoughts below.

Leave a Reply