Situations when contributing to an RRSP isn’t worth it

Your Ontario Teachers’ pension benefit is linked to your RRSP contribution room.

The greater the value of your pension benefit, the less room you will have available to contribute to an RRSP.

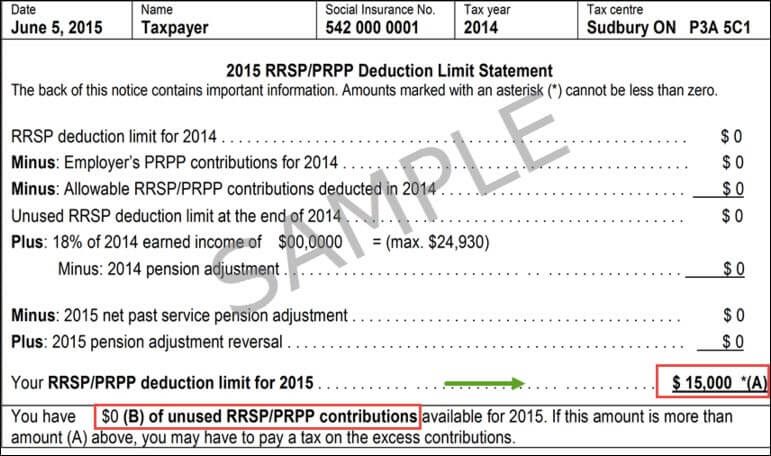

Every member of a registered pension plan receives an annual pension adjustment (PA). Your PA, which appears on your T4, reflects the value of the pension benefits you earned in a year. This is the Canada Revenue Agency’s (CRA) way of leveling the playing field between those who are members of a defined benefit pension plan and those who must rely solely on RRSPs for retirement income.

You can find your RRSP contribution room on the Notice of Assessment provided by the CRA each year.

Payout

Teachers receive a pension based on their years of service and their best five years’ average salary. A teacher who retires with a full pension worked for 32 years and earned a best-five-years average salary of $60,000 would have a basic pension of $38,400. A teacher earning $90,000 a year with 32 years of service would have an annual pension of $57,600. The pension amounts are reduced once teachers are old enough to begin collecting CPP payments because the teachers’ pension plan is designed to be integrated with CPP.

When does an RRSP not make sense?

When you expect to be in a higher tax bracket when you withdraw the funds.

If you have higher taxable income when you withdraw the funds, then you could be paying a higher rate of tax.

Start by getting a Second Opinion Portfolio Review to map out your retirement plans, you might not realize how the various income sources integrate. Focus on these particular areas; what, where, when & how much are the income streams at retirement? When will you start to use your retirement assets? Where will this income stream come from – Pension, RRSP, TFSA, savings, investment properties, private mortgages? What type of income is it – pension income, dividend income, interest income.

The average age of retirement for teachers is 57 although in recent years its been 61. Many teachers find that age too early to stop working and decide to open a business or become a consultant. This while being a great idea to keep busy, will also compound your tax issues at retirement.

When you have a sizeable employer plan or other taxable income sources.

If your employer has a pension plan available, then your already going to build a taxable income stream in retirement. Adding an additional taxable income steam such as an RRSP will only contribute to paying more income tax. As a teacher, your pension adjustment will limit the amount you can contribute to an RRSP anyway.

Many people weigh their RRSP contribution by how much they’re getting back from CRA. Retirement planning is a long-term approach. Utilizing a Goal-Based Planning approach shows you how much you should contribute to achieving your income needs at retirement. It’s a completely different way of thinking. ~ David Aaron

As mentioned previously, having additional income streams at retirement is ideal however, you want to plan ahead as to how to mitigate the tax treatment of those income streams.

What teachers are saying about David

I’ve been a teacher for 12 years and I’ve just always put my allowable limit into my RRSP. After meeting with David, he showed me how to continue funding my retirement using the same amount of money, while not increasing the amount I’ll have to pay to Revenue Canada. Honestly, when David showed me this, I was shocked no one had told me about this before!

Randy

Teacher PDSBEveryone knows being a teacher your going to have a good pension when you retire but I wasn’t sure where to put the extra money I had for savings. An RRSP seemed to be the only option. I had no idea there was an alternative until I met with David. He took his time to explain how it worked and showed me the difference of using this strategy against the RRSP. Can I say my mind was blown! Thanks David.

Elisha

Teacher TDSBSchedule Your Second Opinion Review

It’s Free, with No Obligation

Leave a Reply