Moving the needle forward on becoming financially independent doesn’t mean doing all of these tips, although why not try adopting 1 or 2 each month. From the best ways to budget to how to boost your earning potential like a pro, these tips of financial wisdom are sure to get you headed in the right direction.

First Things First: A Few Financial Basics

1. Create a Financial Calendar

If you don’t trust yourself to remember to pay your quarterly taxes or periodically pull a credit report, think about setting appointment reminders for these important money to-dos in the same way that you would an annual doctor’s visit or car tune-up.

✅ TIP: Consider making a list of your bills and due dates. Leave it out where you see it every day and make a note of when and how much you paid towards the bill. Visually you will see which bills you forgot to pay this month. To keep a good credit score, don’t miss paying at least the minimum due each month.

~ David Aaron, Aaron Wealth Management

2. Check Your Interest Rate

Q: Which loan should you pay off first? A: The one with the highest interest rate. Q: Which savings account should you open? A: The one with the best interest rate. Q: Why does credit card debt give us such a headache? A: Blame it on the compound interest rate. The bottom line here: Paying attention to interest rates will help inform which debt or savings commitments you should focus on.

3. Track Your Net Worth

Your net worth—the difference between your assets and debt—is the big-picture number that can tell you where you stand financially. Keep an eye on it, and it can help keep you apprised of the progress you’re making toward your financial goals—or warn you if you’re backsliding.

How to Budget Like a Pro

4. Set a Budget, Period

This is the starting point for every other goal in your life. Debt can creep up on you. It’s so easy to accept small financial obligations in today’s society with smartphones. Some of those apps on your phone are free while others have a small monthly fee. Netflix’s basic plan is only $10 per month, so are many other fun and useful apps. Next thing you know you’re into hundreds of dollars in monthly obligations.

✅ TIP: Consider looking at your life as a business or corporation. You can only spend what you earn and you also need to conserve cash for future growth and for rainy days.

~ David Aaron, Aaron Wealth Management

5. Consider an All-Cash Diet

If you’re consistently overspending, this will break you out of that rut. Now, this is a little harder to do given many companies want a credit card just to open an account. Try renting a car without a credit card for example. The benefit of paying cash for as many things as possible is being hyper-aware of what you’re spending your money on.

6. End of day money review

At the end of your day take a couple of minutes to review what you spent money on (Hopefully one bill was a deposit to your savings). This reflection helps to identify problems or negative patterns immediately and keeps track of goal progress.

✅ TIP: You make XX amount of money each year. The moment you buy something you’ve given up that money. It’s gone forever. Ask yourself this question: How does this purchase add value to my life?

~ David Aaron, Aaron Wealth Management

How to Get Money Motivated

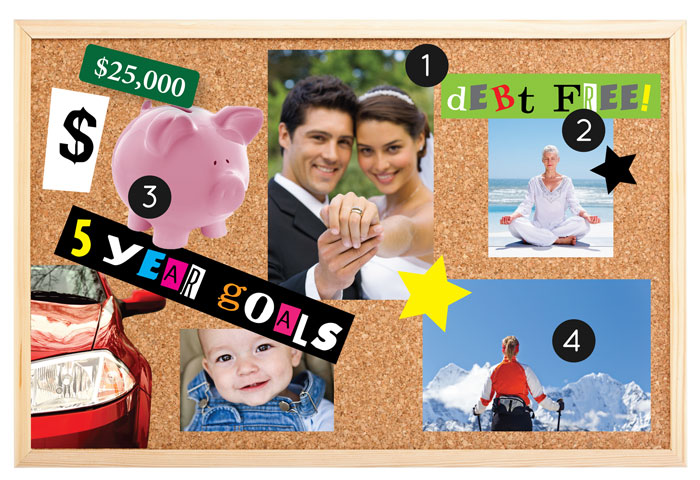

7. Create a Financial Vision Board

You need the motivation to start adopting better money habits, and if you craft a vision board, it can help remind you to stay on track with your financial goals. More than that it’s a psychological trick ( a healthy one). Your subconscious mind will work day and night (that’s right, even when your sleeping) to bring these images into reality.

8. Set Specific Financial Goals

Use numbers and dates, not just words, to describe what you want to accomplish with your money. How much debt do you want to pay off—and when? How much do you want saved, and by what date? Napoleon Hill’s book “Think & Grow Rich” has a chapter which in my opinion is one of the best step-by-step processes to helping you achieve any goal, especially financial goals.

9. Make Bite-Size Money Goals

One study showed that the farther away a goal seems, and the less sure we are about when it will happen, the more likely we are to give up. So in addition to focusing on big goals (such as, buying a home), aim to also set smaller, short-term goals along the way that will reap quicker results—like saving some money each week in order to take a trip in six months.

1o. Banish Toxic Money Thoughts

This has everything to do with your internal dialog and how you view money. Negative thoughts and spoken words have power. Cut them off right in there tracks.

✅ TIP: Be mindful of your thoughts and choose your words carefully. Karma is the energy created by thoughts and words. Careless thoughts & words will produce negative energy. Good thoughts & words produce good energy. If you want good things to show up in your life, cut out your negative thoughts & words.

~ David Aaron, Aaron Wealth Management

11. Get Your Finances–and Body—in Shape

One study showed that more exercise leads to higher pay because you tend to be more productive after you’ve worked up a sweat. So taking up running may help amp up your financial game. Plus, all the habits and discipline associated with exercising are also associated with managing your money well.

12. Appreciate what you have

Do you have clothes hanging in your closet with tags still on them? Maybe it was an impulsive purchase or you couldn’t pass up a sale. Being content with what you already have is not only a healthy state of mind, it will also slow your impulsive spending.

How to Amp Up Your Earning Potential

13. When Negotiating a Salary, Get the Company to Name Figures First

If you give away your current pay from the get-go, you have no way to know if you’re lowballing or highballing. Getting a potential employer to name the figure first means you can then push them higher.

14. You Can Negotiate More Than Just Your Salary

Your work hours, official title, maternity and paternity leave, vacation time, and which projects you’ll work on could all be things that a future employer may be willing to negotiate. Employers have learned lessons from COVID-19 and are more inclined to have employees work from home. This is a huge saving for employees in areas such as; transportation, dining out, work clothes, and even time. Yes, time is money.

15. Make Salary Discussions at Your Current Job About Your Company’s Needs

Your employer doesn’t care whether you want more money for a bigger house—it cares about keeping a good employee. So when negotiating pay or asking for a raise, emphasize the incredible value you bring to the company.

How to Keep Debt at Bay

16. Start With Small Debts to Help You Conquer the Big Ones

If you have a mountain of debt, studies show paying off the little debts can give you the confidence to tackle the larger ones. You know, like paying off a modest balance on a department store card before getting to the card with the bigger balance. Of course, we generally recommend chipping away at the card with the highest interest rate, but sometimes psyching yourself up is worth it.

17. Don’t buy too much house

This happens when you fall in love with a house where your mortgage is near 30% of your take-home pay. You’re going to curse that house you fell in love with when your not able to enjoy living because you have no money left.

How to Shop Smart

18. Evaluate Purchases by Cost Per Use

It may seem more financially responsible to buy a trendy $5 shirt than a basic $30 shirt—but only if you ignore the quality factor! When deciding if the latest tech toy, kitchen gadget, or apparel item is worth it, factor in how many times you’ll use it or wear it. For that matter, you can even consider cost per hour for experiences!

A good example of this is your bedroom. You’re going to spend about a third of your life in bed and getting a great sleep is immeasurable. We waited for the bedroom set we loved to go 50% off. It cost us $13,000 and we kept it for 14 years. Sounds crazy to calculate this but…it cost us $2.55 to sleep each night over those 14 years!

19. Spend on Experiences, Not Things

Putting your money toward purchases like a concert or a picnic in the park—instead of spending it on pricey material objects—gives you more happiness for your buck.

20. Go shopping by yourself

Ever have a friend declare, “That’s so cute on you! You have to get it!” for everything you try on? Save your socializing for a walk in the park, instead of a stroll through the mall, and treat shopping with serious attention.

How to Save Right for Retirement

21. Start Saving NOW!

Not next week. Not when you get a raise. Not next year. Today. Because the money you put in your retirement fund now will have more time to grow through the power of compound growth. Albert Einstein said, “Compound Interest is man’s greatest invention.”

22. Do Everything Possible Not to Cash Out Your Retirement Account Early

Dipping into your retirement funds early will hurt you many times over. For starters, you’re negating all the hard work you’ve done so far saving—and you’re preventing that money from being invested. Second, you’ll be penalized for an early withdrawal, and those penalties are usually pretty hefty. Finally, you’ll get hit with a tax bill for the money you withdraw. All these factors make cashing out early a very last resort.

22. Get that free cash

Take advantage of your employer’s group retirement plan as many plans match your contribution (to a maxed percentage). But you’ll only get that contribution if you contribute first. Another hidden advantage is the fee for investing. Group plans tend to have very low investment fund fees (under 1%). To get these low fees outside your group plan you would either need a lot of money to qualify for a lower fund fee or invest in index funds & Exchange Traded Funds (ETF). A group plan solves that issue for you.

23. When You Get a Raise, Raise Your Retirement Savings, Too

You know how you’ve always told yourself you would save more when you have more? We’re calling you out on that. Every time you get a bump in pay, the first thing you should do is up your automatic transfer to savings, and increase your retirement contributions. It’s just one step in our checklist for starting to save for retirement.

Building credit

24. Review Your Credit Report Regularly—and Keep an Eye on Your Credit Score

This woman learned the hard way that a less-than-stellar credit score has the potential to cost you thousands. She only checked her credit report, which seemed fine—but didn’t get her actual credit score, which told a different story.

25. Keep Your Credit Use Below 30% of Your Total Available Credit

Otherwise known as your credit utilization rate, you calculate it by dividing the total amount on all of your credit cards by your total available credit. And if you’re using more than 30% of your available credit, it can ding your credit score. If your interested in having the best score keep your utilization rate below 10%.

26. If You Have Bad Credit, Get a Secured Credit Card

A secured card helps build credit like a regular card—but it won’t let you overspend. And you don’t need good credit to get one!

How to Get Properly Insured

27. Get More Life Insurance on Top of Your Company’s Policy

That’s because the basic policy from your employer is often far too little and if you get fired so too is your life insurance. There are usually provisions to continue your insurance although the price is not as competitive as getting your own. Life insurance will never be cheaper than it is today. Sounds like a sales phrase but seriously, it’s based on your age & health. It gets more expensive for you to buy as you age so lock in those premiums now.

28. Get Renters Insurance

It, of course, covers robberies, vandalism, and natural disasters, but it could also cover things like the medical bills of people who get hurt at your place, damages you cause at someone else’s home, rent if you have to stay somewhere else because of damage done to your apartment—and even stuff stolen from a storage unit. Not bad for about $30 a month!

Be Prepared for Rainy (Financial) Days

29. Make Savings Part of Your Monthly Budget

If you wait to put money aside for when you consistently have enough of a cash cushion available at the end of the month, you’ll never have money to put aside! Instead, bake monthly savings into your budget now.

30. Keep Your Savings Out of Your Checking Account

Here’s a universal truth: If you see you have money in your checking account, you will spend it. Period. The fast track to building up savings starts with opening a separate savings account, so it’s less possible to accidentally spend your vacation money on another late-night online shopping spree.

✅ TIP: Grant Cardone says, “Get Broke each month. Get rid of your savings. You can’t save your way to being wealthy. You need to get it invested as quickly as possible.”

~ Grant Cardone, Grantcardone.com

31.. Direct Deposit is (Almost) Magic

Why, you ask? Because it makes you feel like the money you shuttle to your savings every month appears out of thin air—even though you know full well it comes from your paycheck. If the money you allot toward savings never lands in your checking account, you probably won’t miss it—and may even be pleasantly surprised by how much your account grows over time.

32. Consider Switching to a Credit Union

Credit unions aren’t right for everyone, but they could be the place to go for better customer service, kinder loans, and better interest rates on your savings accounts.

33. There Are 5 Types of Financial Emergencies

Hint: A wedding isn’t one of them. Only dip into your emergency savings account if you’ve lost your job, you have a medical emergency, your car breaks down, you have emergency home expenses (like a leaky roof), or you need to travel to a funeral. Otherwise, if you can’t afford it, just say no.

34. Have 6 months of emergency cash

Rule #1. Pay Yourself First! Start saving right away into an account where this money will only be used in the case of an emergency as mentioned above. There are many opinions on the amount, although 6 months of expenses is appropriate.

How to Approach Investing

35. Pay Attention to Fees

The fees you pay in your funds, also called Management Expense Ratios (MER), can eat into your returns. Even something as seemingly low as a 1% fee will cost you in the long run. Index funds & Exchange Traded Funds (ETF) are the lowest fees on the market although bear in mind getting advice may be challenging as fees are used to pay for the advice. A low fee may mean no advice.

36. Rebalance Your Portfolio Once a Year

If you’re not getting advice from an advisor then you will need to do this yourself. I strongly recommend you use an advisor, studies show investment accounts with an advisor are higher as compared to no advice. What does Rebalancing mean? Let’s say you had allocated your portfolio to have 60% equities & 40% bonds. Throughout the year these values change because of gains or losses in your investments. At the start of the year, rebalance your portfolio to ensure you still have a 60/40 split.

Get the benefit of experience and knowledge from a team of seasoned professionals who can assess your needs and suggest appropriate strategies. Simply saving money isn’t enough – creating a financial plan with the help of professionals will help you achieve your goals much faster.

Schedule your retirement planning meeting today.

No Obligation & Confidential

Leave a Reply