Besides loving education, summers off (for those of you not teaching summer school) above-average income (average Canadian employment income according to StatsCan age 45-54 is $64,800; age 35-44 was $59,600) plus benefits, teachers will receive a great pension.

The Ontario Teachers’ Pension Plan provides a pension income example: If you earn $85,000 in your five highest salary years and have 30 years of credit, your basic annual pension would be 2% × 30 × $85,000 = $51,000.

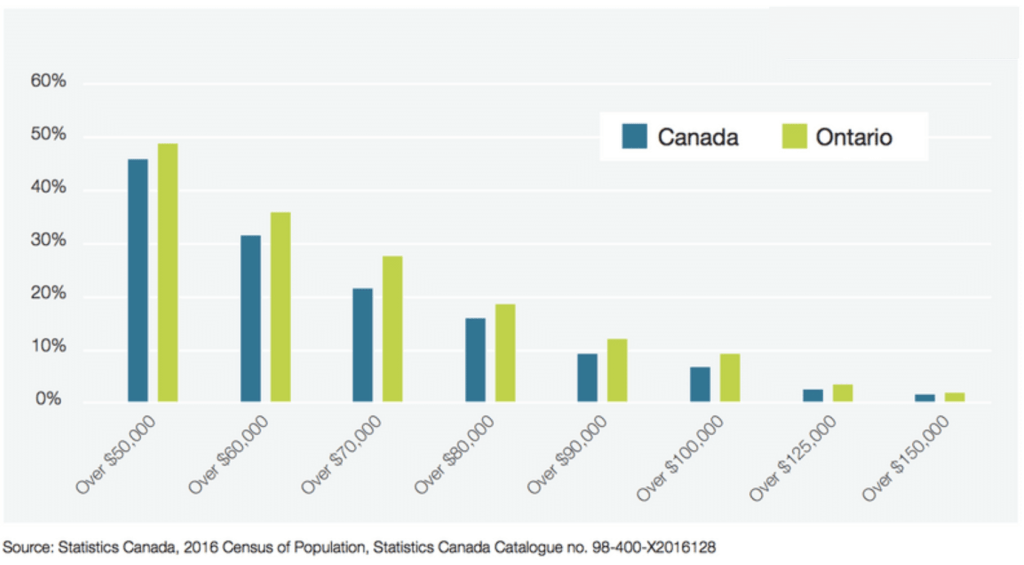

According to StatsCan, a retired couple had annual expenses between $40,800 to $48,600. Approximately 50% of retired couples have a combined total after-tax income greater than $50,000.

Couple: Cumulative after-tax income

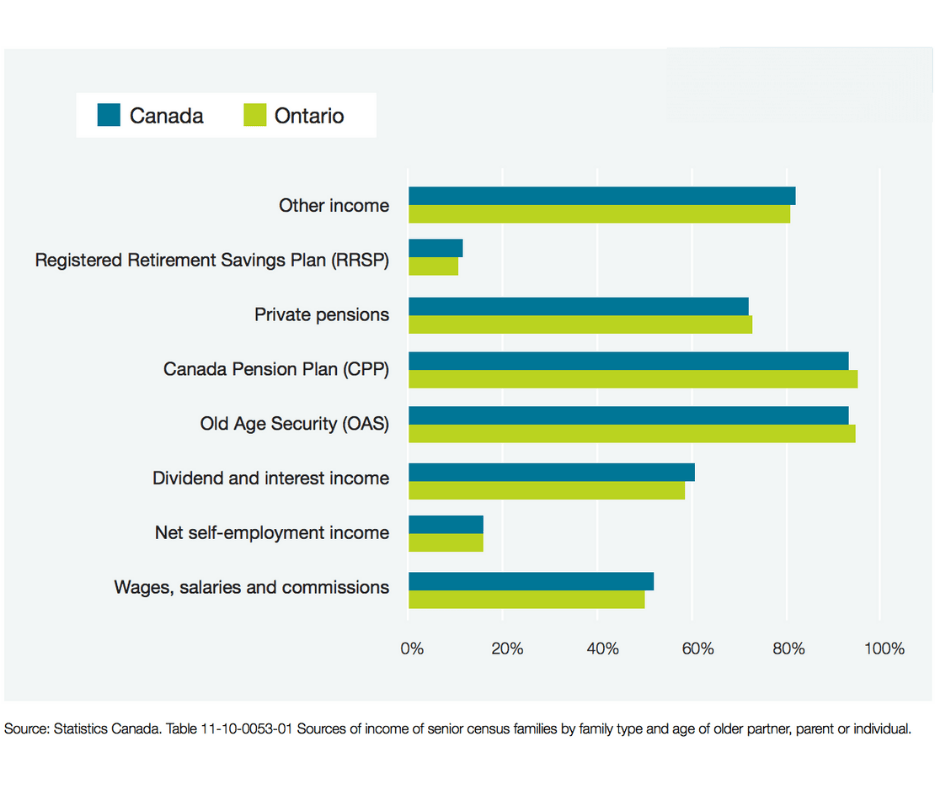

Sources of Income

When teachers marry teachers

When teachers marry another teacher and work as a teacher until they retire, their combined retirement income will provide income well above their living expenses (assuming they don’t try to live like the Kardasians). They will have roughly $30,000 of additional after-tax disposable income to spend any way they want. The #1 concern people have about retirement is: Will I have enough money to retire? When a teacher marries a teacher, they will not have that concern.

When you pray for rain you have to deal with the mud

Two married teachers really need a financial advisor because they already have their retirement income goal solved. The issue is where do you invest the excess cash you have throughout your retirement years? An RRSP will only create a larger taxable income for you. You’re also going to lose about 35% to taxes at the last death of the couple. What you need is a pool of money that will provide a non-taxable income stream at retirement (if you need it).

The #1 Wealth Building Strategy for Teachers

What if I told you, that you could invest into something that is boring, returned 5-6% per year with no tax, low risk, and if you died would pay your spouse more than 10x what you invested tax-free! How much money would you invest? Sounds too good to be true although this is the one exception that breaks the rule.

It’s Participating Life insurance. There are many advisors who will suggest using Universal life insurance however this should be avoided if using this strategy for wealth building. It may be the only type of permanent insurance the advisor sells, so ask questions.

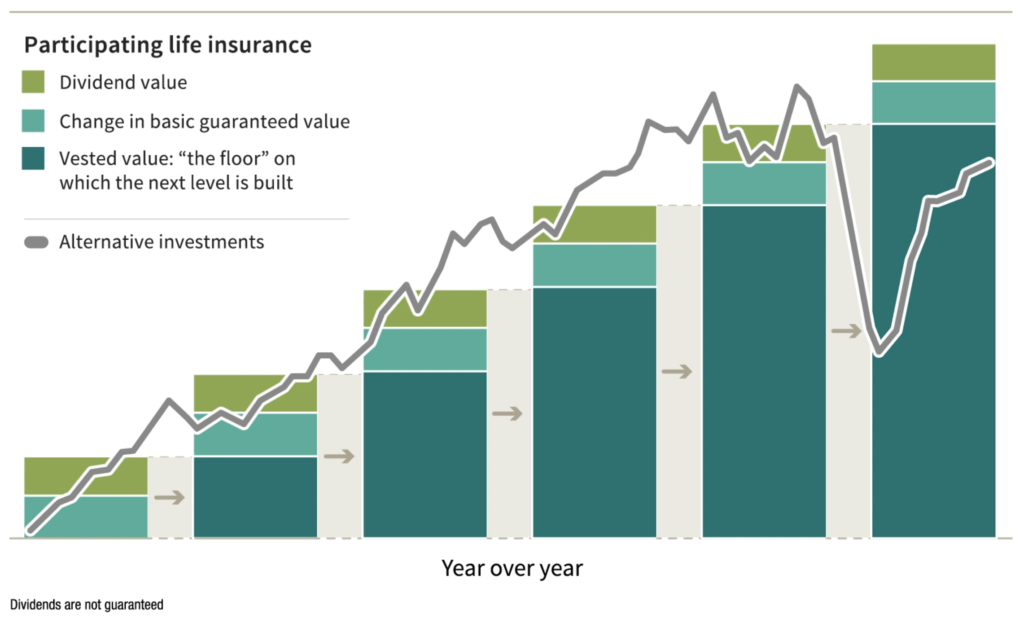

The advantage of participating life insurance is the accumulated cash value in your policy. When the annual dividend is deposited to your policy, it is reinvested into the fund producing compound returns, and because of the nature of how insurance cash values are invested your balance never decreases unlike investing in an RRSP. The illustration below compares the year over a year difference between accumulating cash values vs. the stock market. Note the far right column with a severe market decline (due to Corona Virus). The growth in the insurance cash value was unaffected and continued to grow.

In this strategy, you would deposit money to the insurance policy the same way you would if you were investing in an RRSP. The excess cash above the actual cost of insurance is invested in a fund managed by the insurance company (the fund is actually huge, about $41 billion). Because the money is used to pay death claims & dividends, the investment allocation has to be conservative. You’ll find about 20% of the fund is invested in the stock market and the rest are bonds, mortgages & private placement. The fund is largely unaffected by severe downturns in the stock market.

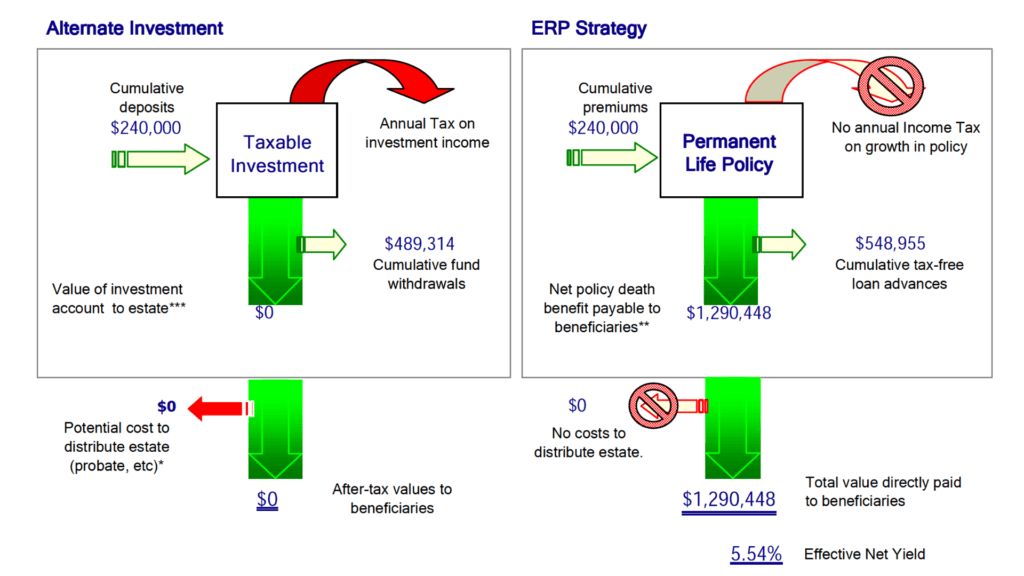

Not all investments are equal

The illustration above compares a non-registered investment vs the participating life insurance. In this example on the left, we are depositing $1,000 per month for 20 years. In the mutual fund, $240,000 is invested and grows at 7% but is taxed each year. Annual taxation on the fund is a drain upon the longevity of the use of funds. A total of $489,314 is withdrawn over retirement. The owner passes away and there is No money left to pass to his/her heirs.

In the insurance example on the right, the same amount of money is invested, $1,000 per month for 20 years for a total of $240,000. There is no tax on the growth of the cash value which is one of the main advantages of participating life insurance. Over the course of retirement, the owner withdraws $548,955 ($59,641 more than the mutual fund) and the owner passes away at the same age as the mutual fund example. At his/her passing, $1,290,448 goes to his/her beneficiaries tax-free!

Clearly, the life insurance investment a superior wealth building solution as compared to an RRSP.

Additional advantages

Two teachers with pension income and RRSPs accounts will likely experience a claw-back of their government retirement income whereas, the income received from the life insurance is tax-free and will not affect their government retirement income.

Schedule your retirement planning meeting today.

No Obligation & Confidential

Leave a Reply